From Growth to Strategy: What 2025 Taught Operators About Esports Betting

Published: 19.11.2025

Why are sportsbook operators expanding into esports betting?

Sportsbook operators are adding esports because it delivers the audience and activity levels that traditional sports struggle to reach. It attracts younger bettors, drives more in-play engagement, and increases higher-value betting activity that supports both retention and handle.

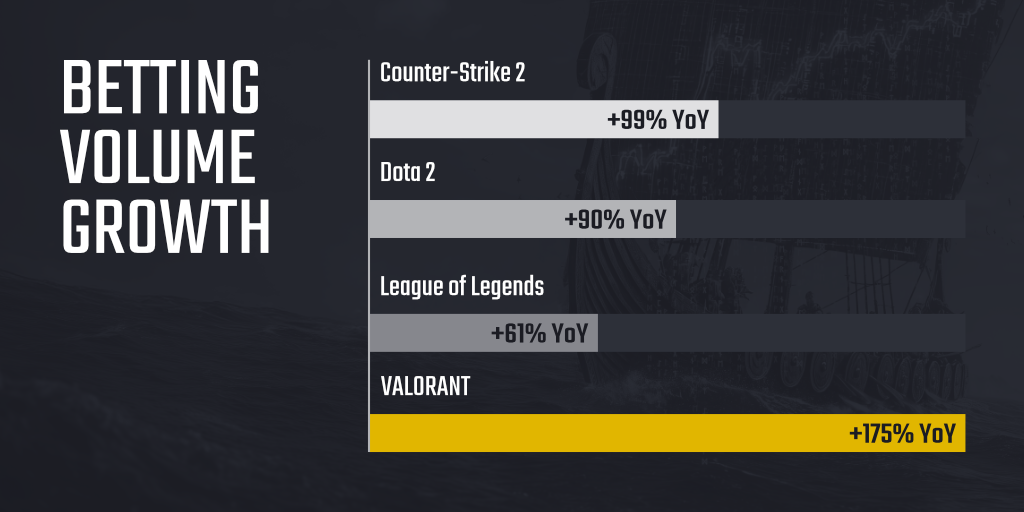

Between 2023 and 2024, betting volume across Counter-Strike 2, Dota 2, League of Legends, and VALORANT grew by 106%, and activity from the same bettor pool rose by 70%. The shift shows that esports is no longer a niche side category. It has become a consistent revenue contributor and, for many operators, a strategic pillar.

TL;DR

Because 2025 data proved the value of esports, the category has evolved from a test product to a top-three vertical, driven by triple-digit growth, stronger retention, and more mature products. Operators that once treated it as an experiment are now budgeting for it like any other core sport.

What did 2025 reveal about the value of esports betting?

“Next big thing” status doesn’t last forever, and in 2025, esports betting stopped being a future play and started shaping sportsbook strategy in the present.

What was once treated as a test product or niche add-on is now part of boardroom planning. A closer look at the data explains why. Betting volume across the top four esports titles rose by 106% year-on-year between 2023 and 2024, but the standout insight is the 70% growth in activity from the same bettor pool. That increase shows that esports isn’t only bringing in new bettors; it’s prompting existing ones to return more often and place higher-value bets.

For several Oddin.gg partners, esports has climbed into the top three verticals by handle, sitting alongside football and basketball. And the conversation has shifted. It’s no longer “should we offer esports?” but “how do we build it right?”

What we learned about esports in 2025

2025 has shown how fundamental esports is to sportsbook performance. Three signals stand out:

- Demographics operators can’t afford to miss. Core esports like Counter-Strike 2 (CS2) or League of Legends attract bettors in their 20s and early 30s—a demographic that’s largely absent from legacy sports like baseball or horse racing. Capturing that audience isn’t about short-term diversification; it’s about ensuring your sportsbook remains relevant for decades.

- Engagement is deeper, not just broader. The data shows that esports leads to repeatable, sustainable engagement that increases customer lifetime value. A 70% rise in activity among sampled existing bettors shows that the main esports demographic aren’t the type to bet just once or twice. They are return visitors that lead to long-term revenue potential.

- Esports is becoming a core part of the sportsbook menu. For many operators, esports now ranks just behind football and basketball by handle. That’s a far cry from the niche category it was treated as just a few years ago.

The takeaway is clear: esports isn’t a nice-to-have vertical anymore. It’s a proven revenue driver that’s actively reshaping how bettors interact with sportsbooks.

One size doesn’t fit all: How is esports betting evolving across regions?

While the global numbers tell one story, the reasons operators are expanding into esports—and how they’re doing it—differ by region. That nuance matters when designing a growth plan.

LatAm: Growth engine of the moment

Latin America remains the standout growth region in 2025. Explosive engagement around Counter-Strike 2 and Dota 2 has pushed esports into the top three sports by handle in several markets. One Oddin.gg partner in Brazil even ranks it second to football. With a young, digitally native population, increasing access to the internet, and significant crossover between esports fans and sports bettors, operators are rapidly expanding market depth and experimenting with new engagement tools to capture share.

United States: A sleeping giant waking up

The U.S. story is more about preparation than immediate scale. As more states legalize online betting, most operators still remain focused on traditional sports, but the smart ones are already laying the groundwork for esports. The demographic pull and diversification opportunities are proving too strong to ignore. Those building esports infrastructure now will be best positioned when regulatory clarity and demand converge state-by-state.

Africa: Skipping straight to digital

Africa’s mobile-first betting markets are still in the early stages, but the potential is huge. With a strong appetite for football, eSimulators—fast, live, head-to-head digital matches based on traditional sports—are emerging as a natural fit. They bridge the gap between esports and sports, making them an accessible entry point for bettors who might not yet follow CS2 or League of Legends.

SEA and Europe: Maturity and momentum

Southeast Asia and Europe are past the early-adoption phase. The conversation there has shifted to differentiation. Deep market offerings, player-focused props, and innovative engagement layers like BetPeek (which lets bettors explore matches through player POVs, map views, and instant replays) are raising expectations. Operators here aren’t just adding esports; they’re refining how it’s delivered.

What product innovations are driving esports betting growth?

Early esports offerings were little more than match odds on a menu. Today, bettors expect esports to behave like any other core vertical, and that means operators must deliver comparable depth, engagement, and control.

Here’s how leading operators are responding:

- Depth and variety: Player-based markets give bettors more ways to engage with individual matches and players.

- 24/7 content: Always-on options, from core esports to eSimulators such as eFootball and eBasketball, keep books active even in off-seasons.

- BetBuilder, now live: Combining markets across a single match has become standard in sports, and now it’s available for esports too—both pre-match and live.

- Interactive viewing layers: Solutions like BetPeek transform passive watching into interactive engagement, giving bettors more control over how they experience each event. This increases both session time and betting frequency.

Each evolution raises the bar and increases the cost of being behind. What once set operators apart will soon be table stakes.

How operators can build sustainable esports betting strategies for 2026

2025 settled the question of whether esports deserves a place in the sportsbook. The next question is how to turn that presence into long-term performance.

Three priorities stand out as operators plan for 2026:

- Build for scale, not experimentation. Bettors and betting volume will keep growing. Those who treat esports as a side project risk being outpaced by operators already refining second-generation tools.

- Think beyond odds. Profitability doesn’t come from data feeds alone. It’s the combination of data, risk, content, and engagement tools that drives real revenue impact.

- Tailor your strategy by region. LatAm’s rapid growth, Africa’s emerging opportunity, and the U.S.’s future leadership each require a different go-to-market approach.

The gap between early adopters and late entrants is already widening. Operators that entered esports two or three years ago are now iterating on advanced features like BetBuilder and player props. Those starting today will likely have to race to catch up.

Conclusion: Esports isn’t the future; it’s the foundation.

2025 confirmed what the early movers already knew: esports isn’t a trend, and it’s not a sideshow. It’s a vertical capable of driving serious revenue, reaching new demographics, and transforming how bettors engage with sportsbooks.

For operators, the lesson is clear. Esports betting is no longer a question of if—it’s a question of how well you can execute. And in a market where bettor expectations, products, and competition are all growing, waiting another year isn’t cautious. It’s ceding ground to those already building for what’s next.

YOU MIGHT BE INTERESTED

The Hidden Complexity of Esports Betting

Discover why building a profitable esports betting product is one of the toughest tasks in the industry.